SmarTech was impressed with HP’s metal printing announcements at IMTS 2018. The company announced a new metals printing technology based on a binder jet approach, a metals service bureau offering (of sorts) that lets new customers try out HP’s new technology, and a group of apparently happy customers, who had tried it out already.

The Second Coming of HP AM

In some ways we see IMTS as HP’s reboot on AM, repeating some of the same, mostly successful, strategic thinking that went into the company’s original entry into 3D printing several years ago:

• What HP was offering back then was a semi-proprietary 3D printing technology for polymers based in part on the company’s long experience of jetting. HP in its various corporate incarnations has more than 30 years of print head and advanced chemistries development.

With HP’s new “Metal Jet” technology, HP is again harking back to its old ink jet technology to some degree. HP Metal Jet is voxel-level binder jetting technology with a bed size of 430 x 320 x 200mm. The new machine will be based on a powder binding technique inspired by MIM (Metal Injection Molding). In the first instance HP Metal Jet will print stainless steel finished parts, then move on to titanium

• HP entered the 3D printing business just after company was split in two. HP was quite clear at the time that it saw the 3D printing of parts as an important new industry and that it intended to be a leader in the field with 3D printing eventually accounting for a major slice of HP’s business. Not only was HP putting itself on the 3DP map back then, but HP established 3D printing as a medium volume production process, lending credibility to 3D printing – much like IBM did with PCs back in 1981.

HP couldn’t quite repeat this act at IMTS. At the time of its original announcement no one had proven that 3DP as a general production technology was viable. This time around metal parts printing is already well established so instead HP offered a strong message that in the addressable markets that HP is chasing, HP was definitely the go to firm for printed metals.

HP Enters the Metal Service Bureau Business

What HP also did at IMTS was showcase a new metal printing service offering – the Metal Jet Production Service (MJPS). This service will be available in the first half of 2019, and is clearly designed to compete with similar services from the giants of 3D printing such as 3D Systems and Stratasys.

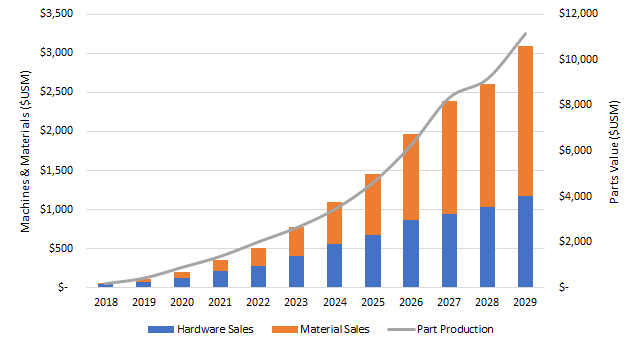

Such services have been around for years, but SmarTech does not believe that HP will have much problem winning orders for its service. As we show in our new report, Metal 3D Printing Services: Service Revenues, Printer Purchases And Materials Consumption – 2018 To 2027, metal printing is growing rapidly due to the difficulty of reliably printing metal parts and the desire of some end users (especially in the aerospace industry) to offload technology risk to third parties.

Users of MJPS will be able to upload 3D design files and receive industrial-grade parts in large quantities:

• As with other similar services offered by HP’s rivals MJPS is designed as a lure to future customers of HP’s metal printing technology. First customers buy the service and then when the printers themselves become available they are well set up to become early buyers of the machines themselves. As HP itself puts it, MJPS allows customer to see the advantage before plunking down $400,000 for a printer. (Incidentally, in its IMTS announcement HP claimed that its technology is offered at significantly lower cost compared to other binder jetting systems

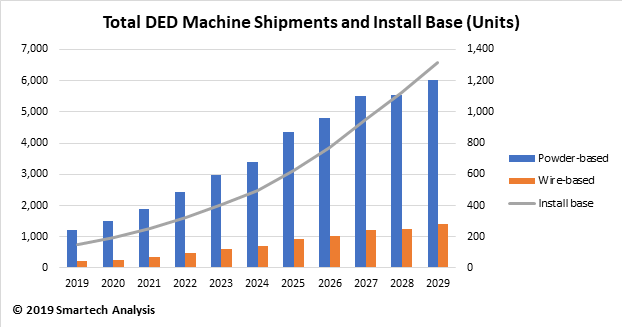

• Also, MJPS will allow HP to ramp up its printer production more slowly than if it had to satisfy customer needs with orders in the near future. HP Metal Jet printers will begin shipping in 2020 to early customers and with broad availability in 2021.

Metal AM at HP: Assessing the Risks

We have always been bullish about HP’s long-term prospects in AM and we remain so. However, impressive announcements have to be delivered upon. In particular, SmarTech sees two areas that bear watching:

• One of these is the technology itself. It’s a new technology, a fact in which risks are inherent and HP is claiming very big things for its technology, most notably that it can provide “up to 50 times more productivity at a significantly lower cost. HP is very careful to specify what it is referring to here – “comparable competitive binder jetting and SLM metals 3D printing solutions available as of July 31, 2018.” Productivity claim based of serial production up to 100,000 parts. But things change as new technologies hit the market. Incidentally, for Metal Jet HP compares its machines to industrial metal machines from 3D Systems, EOS or Arcam

• The other risks are in the way that MJPS is being provisioned. HP does not provide manufacturing services. Customers work directly with and pay for manufacturing services provided by a trusted third-party manufacturing partner responsible for fulfilling the order. For example, HP is partnering with GKN Powder Metallurgy to provide Metal Jetted parts to auto and industrial leaders including Volkswagen. HP provides a design compatibility check for HP Metal Jet printing. So in reality, a relationship where the HP has ceded some of the control in an important new venture to others. Partnering can makes sense in some cases but is it going to be an effective pitch to customers who may have more fully integrated service options?