On May 9th, SLM Solutions stock made its debut on the Frankfurt stock exchange. SLM’s IPO gave investors another opportunity to invest in the bourgeoning metal 3D printing sector, joining the likes of Arcam, ExOne, and 3D Systems on the list of public companies involved in the metal 3D printing space. The original offering raised around 180 million euros, or $246 million dollars in new capital.

SLM’s shares opened at 18 euros: the lower end of the suggested 18-23 euro price range. This price suggests that investors were leery, given lagging performance from 3D printing stocks in the last few months. However, the hype for 3D printing soon caught up to SLM. Two days after the IPO, SLM’s stock rose 14.3% to 21.4 euros. Since then, SLM’s stock has settled a bit, floating in the 19-20 euro area.

Two days ago, on June 2nd 2014, SLM Solutions announced it was exercising their greenshoe option early, for near the maximum amount allotted for. The move signals strong institutional interest in the company. In total, an additional 1.17 million shares were sold in institutional investors that increase the free float of the company to 56%.

Despite many reports on the deal that referenced Arcam, ExOne, and 3D Systems as SLM’s closest competitors, SLM’s most closely competes with EOS and Concept Laser. SLM’s technology is most comparable to the equipment these two companies, which encompasses fusing together layers of metal powder on top of a powder bed by tracing a layer design with a high-powered laser.

A large capital infusion could help SLM step up and become a major player player in this space. This is especially true given the penchant of large corporate customers to spread their investment in industrial metal 3D printers across a number of different equipment companies.

SLM’s seems to be moving more towards EOS’s and Concept Laser’s business model quite literally. Last year, SLM opened its North American headquarters literally minutes from EOS’s North American offices last year in Novi, Michigan. SLM has stated that 75% of the raised capital will go towards its growth strategy. We expect much of this new capital to go towards building in-house expertise and ramping up its service capabilities.

The addition of another capable company could help expand the market for large format, industrial metal 3D printers. It will also increase competition in this market. However, SLM still has a ways to go in terms of catching up to market leaders EOS and Concept Laser.

SLM’s 25 machines sold in 2013 account for only about one forth the sales of each market leader. It may also take some time for SLM to catch up to the progress EOS’s and Concept Laser’s build path software (the software that plans and executes the path the laser travels across the powder bed) and in-situ monitoring systems.

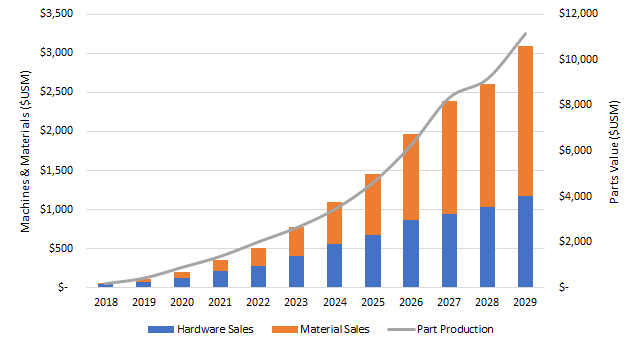

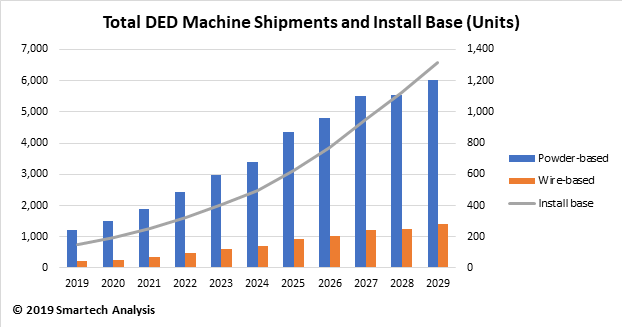

SmarTech is bullish on the market for industrial meatl 3D printers over the next ten years. We expect the annual global demand for these machines to increase to 2,100 machines by 2019, an average annual growth rate of 35%.

In total, we believe the substantial size of this opportunity will allow for ample room for all metal 3D printing companies to excel. We expect that SLM will establish itself as a viable option in this market with its superior materials portfolio and blue-chip customer base. Keep in mind that SLM Solutions may also offers perhaps the only way to invest in this niche of 3D printing for the foreseeable future, as Concept Laser and EOS have expressed zero interest in appealing to public markets.